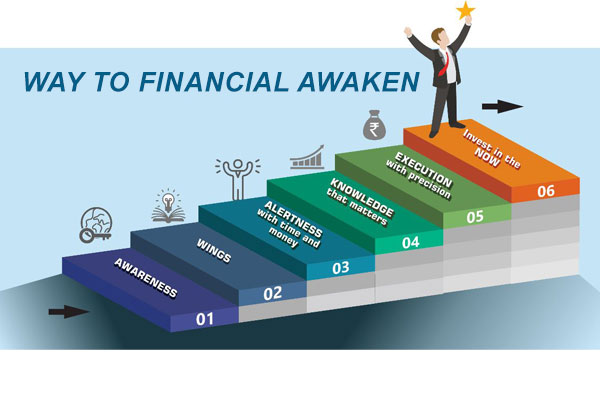

We have designed a revolutionary financial planning process called AWAKEN. Lets discuss the complete steps of AWAKEN to have a better idea of how it works and how it benefits the people.

AWARENESS

The first step of AWAKEN is awareness. Here we got to know about the client and client knows about us. The underline purpose of this process is to be aware about our natural abundance. I have a firm belief and conviction that we all are born abundant. Universe has endowed all of us the infinite abundance. You can notice this all around you. Sun the ultimate source of energy, power and vitality is available for all of us. Then there is water, fresh air, trees, vegetables, fruits, natural resources, the list is endless. The whole Universe is so miraculous. It is infinitely beautiful and benevolent for all of us including those who are classified as poor in our society.

A closer look at yourself also indicates that you are so much abundant already. I think the breath that you take is your biggest abundance. Then you have all the organs in your body which are infinitely invaluable. The whole life is so beautiful and amazing. Once you realize this abundance within and without you, then you feel like a truly abundant person. Your heart is then filled with gratitude. You thank the Universe (we may call it God also) for such a miraculous experience in your life. When we remain so trapped in our scarcity thoughts, we fail to recognise this infinite abundance in our life. Then the whole Universe becomes dead for us. We feel grumbled and unhappy. But when we got the AWARENESS of our natural abundance, then the whole Universe become so much friendly to us.

And then when you feel abundant, you start attracting more abundance in your life. Thats the law of attraction. Your thought and feelings attract the similar things in your life. If one could study the life of successful and wealthy people, this would get absolutely clear that these people possess the thought and feelings of abundance. They treat themselves and others very well; they appreciate all the good things of life. For them life is always an opportunity not a challenge. They don’t even confine the wealth to themselves because they know that abundance is coming to them in infinite measure and the more they share, the more they get. You can see how happily, they do charity and still the wealth is keep pouring in at brisk pace.

So the goal of achieving abundance cannot be achieved if you are unhappy with your current condition. If you can not acknowledge the abundance which is already there, you cannot attract more abundance. Even what you have will also be taken away.

This is the awareness of your inborn abundance we are talking about. Any wealth planning can not travel the distance if we are not aware about the wealth correctly. So the wealth planning starts from recognising the abundance and feel grateful for that. And then you become multiplier of wealth for the larger good rather than seeking it to cover up your thought of lack. Wealth creation then become enjoyable rather than something that you are forced to do. That is the real abundance.

Thats the discussion, we get engage in with the client. I am sure feeling grateful for your abundance is great start for achieving your financial success.

A closer look at yourself also indicates that you are so much abundant already. I think the breath that you take is your biggest abundance. Then you have all the organs in your body which are infinitely invaluable. The whole life is so beautiful and amazing. Once you realize this abundance within and without you, then you feel like a truly abundant person. Your heart is then filled with gratitude. You thank the Universe (we may call it God also) for such a miraculous experience in your life. When we remain so trapped in our scarcity thoughts, we fail to recognise this infinite abundance in our life. Then the whole Universe becomes dead for us. We feel grumbled and unhappy. But when we got the AWARENESS of our natural abundance, then the whole Universe become so much friendly to us.

And then when you feel abundant, you start attracting more abundance in your life. Thats the law of attraction. Your thought and feelings attract the similar things in your life. If one could study the life of successful and wealthy people, this would get absolutely clear that these people possess the thought and feelings of abundance. They treat themselves and others very well; they appreciate all the good things of life. For them life is always an opportunity not a challenge. They don’t even confine the wealth to themselves because they know that abundance is coming to them in infinite measure and the more they share, the more they get. You can see how happily, they do charity and still the wealth is keep pouring in at brisk pace.

So the goal of achieving abundance cannot be achieved if you are unhappy with your current condition. If you can not acknowledge the abundance which is already there, you cannot attract more abundance. Even what you have will also be taken away.

This is the awareness of your inborn abundance we are talking about. Any wealth planning can not travel the distance if we are not aware about the wealth correctly. So the wealth planning starts from recognising the abundance and feel grateful for that. And then you become multiplier of wealth for the larger good rather than seeking it to cover up your thought of lack. Wealth creation then become enjoyable rather than something that you are forced to do. That is the real abundance.

Thats the discussion, we get engage in with the client. I am sure feeling grateful for your abundance is great start for achieving your financial success.

Wings

Ask and it will be given to you. Once you are truly aware of your real abundance, generation of further wealth become enjoyable for you. It become like a game for you. A complete trust in God gives you power and conviction. Now is the time to express your inner thought and feelings. Articulate your dreams because that is the very first as well the most important step of achieving your dreams.

- Speak up your dreams and write them down. Share them with us. Its only when you share your dreams with somebody you trust, they become solid.

- Feel your dreams. Believe that you have already received your dreams. Feel the feelings of achieving your dreams. For example, I feel as if I have already materialised my dream of making “Mainstream as a national company”. Anything that you can think and feel would surely be real. So in that sense, your thoughts and feelings are as real as real itself.

- Once you articulated your dreams and start believing them, you start receiving them. At this stage, don’t worry about how the dreams will be achieved. You have done your part. Now the Universe will figure out, the ways and means to achieve your dreams. The important thing is that you have to be ready for dreams. When the student is ready, teacher appears.

So state your dreams with firm conviction and from the position of abundance, feel as if you have already received your dreams and leave the “How” part to the Universe. It will found out the way to do it. You don’t have to worry about it at all.

Here we encourage people to come out with their dreams, believe them that they are already achieved. Dont doubt about your dreams, there must be some Higher message behind your dreams. The beauty about this approach is that, you do all that as a play. There is no self seeking behind it, hence no ego behind your dreams. You are already aware about your natural abundance and hence any outer wealth could just be a game for you which you play playfully.

- Speak up your dreams and write them down. Share them with us. Its only when you share your dreams with somebody you trust, they become solid.

- Feel your dreams. Believe that you have already received your dreams. Feel the feelings of achieving your dreams. For example, I feel as if I have already materialised my dream of making “Mainstream as a national company”. Anything that you can think and feel would surely be real. So in that sense, your thoughts and feelings are as real as real itself.

- Once you articulated your dreams and start believing them, you start receiving them. At this stage, don’t worry about how the dreams will be achieved. You have done your part. Now the Universe will figure out, the ways and means to achieve your dreams. The important thing is that you have to be ready for dreams. When the student is ready, teacher appears.

So state your dreams with firm conviction and from the position of abundance, feel as if you have already received your dreams and leave the “How” part to the Universe. It will found out the way to do it. You don’t have to worry about it at all.

Here we encourage people to come out with their dreams, believe them that they are already achieved. Dont doubt about your dreams, there must be some Higher message behind your dreams. The beauty about this approach is that, you do all that as a play. There is no self seeking behind it, hence no ego behind your dreams. You are already aware about your natural abundance and hence any outer wealth could just be a game for you which you play playfully.

ALERTNESS with time and money

Again the key is awareness. Normally people are not aware about their inflows and outflows. They also feel bad whenever there is some big expenses. Setting their budget also seems like a daunting task more so because it gives them some emotional pain.

So first and foremost, look at your feelings about your earnings and expenditure. Feel good about your earning and feel good about your expenditure as well. Also feel grateful about your job, your earnings as well as your expenditure. Only when you feel good about your current situation, you will create magical changes in future. Abundance will always elude you if you are not feeling good about your current situation and feel grateful for that. Remember, abundance comes when you feel abundant.

So now develop your budget in a very happy state of mind. State your income and state your expenditure. Be aware about your cash flows. Explore the options of-

- A) Increasing your income

- B) Curtailing expenditure

- C) Be happy if A and/or B can be achieved. Be happy if A and/or B can’t be achieved.

Be aware about every rupee that flows in and out of you. Also feel your sincere gratitude for every rupee that flows in and out of you. There is huge power and energy in gratitude. When you truly feel gratitude than you attract more and more abundance in your life.

So first and foremost, look at your feelings about your earnings and expenditure. Feel good about your earning and feel good about your expenditure as well. Also feel grateful about your job, your earnings as well as your expenditure. Only when you feel good about your current situation, you will create magical changes in future. Abundance will always elude you if you are not feeling good about your current situation and feel grateful for that. Remember, abundance comes when you feel abundant.

So now develop your budget in a very happy state of mind. State your income and state your expenditure. Be aware about your cash flows. Explore the options of-

- A) Increasing your income

- B) Curtailing expenditure

- C) Be happy if A and/or B can be achieved. Be happy if A and/or B can’t be achieved.

Be aware about every rupee that flows in and out of you. Also feel your sincere gratitude for every rupee that flows in and out of you. There is huge power and energy in gratitude. When you truly feel gratitude than you attract more and more abundance in your life.

KNOWLEDGE that matters

Now again the underlying message is to remain aware about the wealth creating opportunities around you. We will discuss here those opportunities and how they will help you in creating huge wealth for you.

The power of compounding- Lets be aware about the most fascinating concept that help us build outer wealth. How Warren Buffet became the third richest man on earth, the answer is power of compounding. How the share value of Wipro has risen from Rs 10,000 in 1980 to Rs 500 Crores, the answer is power of compounding. How your savings can grow to make you financially independent one day, the answer is power of compounding.

For power of compounding be work magically, you need two things- Rate of interests and the time. In the last 100 years of history, shares have delivered far better return than the other avenues including real estate, gold, FDs and bonds. So for building wealth, you need to deploy your savings in shares or share oriented investments. Yes they fluctuate, but they more than compensate it in the long run. Every market fluctuation rather presents an opportunity to augment your wealth.

Basics of Investments- We have briefly discussed about the Equities, real estate, gold and bonds. Now lets see how they can be combined in your investments.

Shares are volatile but provide the best return in the long term. If one could follow certain parameters to watch shares then he should pursue that else its better for most of the investors to invest through mutual funds. While there is great variation in the performance of shares, the variation is quite low in the case with mutual funds if you see their performance of 10 years and above.

Real estate had historically given lower return than the stocks with higher risk. Further there is always an issue of liquidity and division of wealth among successors. Therefore our advice is to take the real estate only for use not for investments.

Gold is generally available in all the household by default, therefore buying gold would not be a great idea either. Still one could buy gold bonds for use for the marriage of the kids.

Bonds and FDs are OK for some portfolio diversification and especially for investments which are for short term goals. Even for long term goals, one should reduce the equity exposure as the goal gets nearer.

As we discussed above that you could afford to make some mistake in fund selection and you would still do very well if you do this correctly. This is called asset allocation.

Asset allocation - Not all your money in invested for say 30 years. There are some short and medium term goals where you would not like to take unnecessary chances by investing in equities. May be you would like to find a right mix between volatile yet high return asset and stable assets. This mix is called the asset allocation. The right asset allocation proved to be the best form of building wealth over a long period of time. It gives you predictable performance and let you focus on augmenting your savings. Research has shown that asset allocation account for 92% of investment success while security selection and market timing account for remaining 8%.

Besides time horizon (how far or near is your goal) the other important thing that determine your asset allocation is your risk tolerance. You may characteristically be a high risk taker than others or the other way around. So it would be useful if you understand your risk tolerance so that your portfolio suits your risk tolerance.

Focus on your dreams -

Focus on your goals and believe that you have already addressed them because you have taken the most important step, the first step towards that.

Your important goals are -

Financial Freedom - Set your financial freedom target and start the saving programme immediately. Financial freedom or retirement planning is the most important goal of your investment. Lets start now and get the maximum power of compounding.

Child Education Planning - Imagine that your kinds are studying among the best colleges. Plan for it in time and happily contribute towards this fund.

Marriage of the kids - This is one happy situation that you want to enjoy fully. Have a plan for that and enjoy the occasion.

Wealth Planning - Imagine whatever you want to enjoy. New Car, Vacation, penthouse.. All is possible with happy thoughts and feeling and working towards them. Fulfilling your dreams is your birthright and you certainly can if you think, feel and believe in your dreams.

Charity and donation - When you feel abundant and joyful, you automatically want to contribute to the world. When you are donating, you are emitting the signal that you are abundant and you are grateful for this abundance. No wonder Universe gives you much more than what you need and you again give it back. This is the beautiful cycle and gets the power of compounding work beautifully. And aren’t we learnt that the power of compounding is what creates super wealth.

Insurance Planning - I feel grateful for Insurance companies because they provide the much needed peace of mind in the wake of life’s uncertainities.

But again, let’s go back to our earlier discussion that thought follow things. So focus more on the wealth creation opportunities and the return rather than the risk of the investments. This way even the market downfall would start looking like an opportunity to you. Think and discuss with your family about the opportunities and success. Dont let it become the atmosphere that of challenges and risks.

Take out every opportunity to put your saving into investment accounts. And do all that too happily. The key to investment success as we are keep repeating is to have a joyful feelings and firm conviction that your investments are making you very rich. Every time you see your portfolio, feel the joyful feeling of already saved that much money. Whether the return looks good or bad as they sometime do because of market conditions, your feelings should always remain joyful. Feel grateful for your investment success so far. Assure yourself that abundance of money is on the way.One more thing that you can do to help yourself is to teach other the secret of money and how it could come to them as well. When you are on a giving spree, whether money, knowledge, appreciation and love, you get all that in abundance. Also for God’s sake, don’t use the term like my hard earned money, it limits the possibility of making tons of money.

Please remember that you are already complete, abundant, peaceful and joyful inside. Now you are simply playing a game of actualising your inner abundance in the outer world. It always works this way.

Knowledge gives you power and conviction. Many times when the world looks against your conviction (especially in the stock market), your focused and specialise knowledge gives you a much needed edge.

I suggest do read the “One up on Wall street” by Peter Lynch to understand your special edge.

The power of compounding- Lets be aware about the most fascinating concept that help us build outer wealth. How Warren Buffet became the third richest man on earth, the answer is power of compounding. How the share value of Wipro has risen from Rs 10,000 in 1980 to Rs 500 Crores, the answer is power of compounding. How your savings can grow to make you financially independent one day, the answer is power of compounding.

For power of compounding be work magically, you need two things- Rate of interests and the time. In the last 100 years of history, shares have delivered far better return than the other avenues including real estate, gold, FDs and bonds. So for building wealth, you need to deploy your savings in shares or share oriented investments. Yes they fluctuate, but they more than compensate it in the long run. Every market fluctuation rather presents an opportunity to augment your wealth.

Basics of Investments- We have briefly discussed about the Equities, real estate, gold and bonds. Now lets see how they can be combined in your investments.

Shares are volatile but provide the best return in the long term. If one could follow certain parameters to watch shares then he should pursue that else its better for most of the investors to invest through mutual funds. While there is great variation in the performance of shares, the variation is quite low in the case with mutual funds if you see their performance of 10 years and above.

Real estate had historically given lower return than the stocks with higher risk. Further there is always an issue of liquidity and division of wealth among successors. Therefore our advice is to take the real estate only for use not for investments.

Gold is generally available in all the household by default, therefore buying gold would not be a great idea either. Still one could buy gold bonds for use for the marriage of the kids.

Bonds and FDs are OK for some portfolio diversification and especially for investments which are for short term goals. Even for long term goals, one should reduce the equity exposure as the goal gets nearer.

As we discussed above that you could afford to make some mistake in fund selection and you would still do very well if you do this correctly. This is called asset allocation.

Asset allocation - Not all your money in invested for say 30 years. There are some short and medium term goals where you would not like to take unnecessary chances by investing in equities. May be you would like to find a right mix between volatile yet high return asset and stable assets. This mix is called the asset allocation. The right asset allocation proved to be the best form of building wealth over a long period of time. It gives you predictable performance and let you focus on augmenting your savings. Research has shown that asset allocation account for 92% of investment success while security selection and market timing account for remaining 8%.

Besides time horizon (how far or near is your goal) the other important thing that determine your asset allocation is your risk tolerance. You may characteristically be a high risk taker than others or the other way around. So it would be useful if you understand your risk tolerance so that your portfolio suits your risk tolerance.

Focus on your dreams -

Focus on your goals and believe that you have already addressed them because you have taken the most important step, the first step towards that.

Your important goals are -

Financial Freedom - Set your financial freedom target and start the saving programme immediately. Financial freedom or retirement planning is the most important goal of your investment. Lets start now and get the maximum power of compounding.

Child Education Planning - Imagine that your kinds are studying among the best colleges. Plan for it in time and happily contribute towards this fund.

Marriage of the kids - This is one happy situation that you want to enjoy fully. Have a plan for that and enjoy the occasion.

Wealth Planning - Imagine whatever you want to enjoy. New Car, Vacation, penthouse.. All is possible with happy thoughts and feeling and working towards them. Fulfilling your dreams is your birthright and you certainly can if you think, feel and believe in your dreams.

Charity and donation - When you feel abundant and joyful, you automatically want to contribute to the world. When you are donating, you are emitting the signal that you are abundant and you are grateful for this abundance. No wonder Universe gives you much more than what you need and you again give it back. This is the beautiful cycle and gets the power of compounding work beautifully. And aren’t we learnt that the power of compounding is what creates super wealth.

Insurance Planning - I feel grateful for Insurance companies because they provide the much needed peace of mind in the wake of life’s uncertainities.

But again, let’s go back to our earlier discussion that thought follow things. So focus more on the wealth creation opportunities and the return rather than the risk of the investments. This way even the market downfall would start looking like an opportunity to you. Think and discuss with your family about the opportunities and success. Dont let it become the atmosphere that of challenges and risks.

Take out every opportunity to put your saving into investment accounts. And do all that too happily. The key to investment success as we are keep repeating is to have a joyful feelings and firm conviction that your investments are making you very rich. Every time you see your portfolio, feel the joyful feeling of already saved that much money. Whether the return looks good or bad as they sometime do because of market conditions, your feelings should always remain joyful. Feel grateful for your investment success so far. Assure yourself that abundance of money is on the way.One more thing that you can do to help yourself is to teach other the secret of money and how it could come to them as well. When you are on a giving spree, whether money, knowledge, appreciation and love, you get all that in abundance. Also for God’s sake, don’t use the term like my hard earned money, it limits the possibility of making tons of money.

Please remember that you are already complete, abundant, peaceful and joyful inside. Now you are simply playing a game of actualising your inner abundance in the outer world. It always works this way.

Knowledge gives you power and conviction. Many times when the world looks against your conviction (especially in the stock market), your focused and specialise knowledge gives you a much needed edge.

I suggest do read the “One up on Wall street” by Peter Lynch to understand your special edge.

EXECUTION with precision

The whole theme of our message is that we all are already complete and already abundant. So anything that we are focussing to achieve on a outer level is already achieved on an inner level. Once this conviction sets in, we are arrived. Now at the external level there is nothing to achieve to feel complete as we are already complete. Now everything we do on the outer level will be like a game for us. Self seeking through outer achievement goes and anything we do will have the quality of inner peace and joy. In such a state, we will approach our goals with enthusiasm and joy.

We have our unique fact finder that opens the gate for external abundance. But that external abundance will just be a mirror image of your inner abundance which you already have in abundance.

Our fact finder will encourage you to define your dreams. It will motivate you to spell out your goals fearlessly. Your conviction and our programme will ensure that they would become a reality. There is merit in trying to chase even the impossible dreams provided dreams don’t become your identity and not able to achieve them would depress you. If you have truly realized the meaning of real abundance than you will address your goals as a game and enjoy them. You are not worried about achievement of these goals. In a way set your goals and start the action plan with enthusiasm and enjoy every step of it. You are neither worrying not striving too hard for it. A simple, effortless, awakened and gamelike chasing of your goals will ensure that they will become your outer reality as well.

Fact finder will also assess your risk tolerance, work out your networth, insurance requirement and estate planning.

We have our research based investment avenues that will make sure that your portfolio gets the best avenues based on your goals, time horizon and risk tolerance.

After feeding all the qualitative and quantitative information, our system would be capable of developing the comprehensive financial plan for you. The comprehensive financial plan will be developed by the financial planner and approved by the Chief Financial Planner before presenting to the client. We will also have Robo plans that the client can develop on his own and if feel can discuss it with our planners.

We will also have a short version of financial plan, that would require much simpler information and plan is developed and can be implemented immediately

We have our unique fact finder that opens the gate for external abundance. But that external abundance will just be a mirror image of your inner abundance which you already have in abundance.

Our fact finder will encourage you to define your dreams. It will motivate you to spell out your goals fearlessly. Your conviction and our programme will ensure that they would become a reality. There is merit in trying to chase even the impossible dreams provided dreams don’t become your identity and not able to achieve them would depress you. If you have truly realized the meaning of real abundance than you will address your goals as a game and enjoy them. You are not worried about achievement of these goals. In a way set your goals and start the action plan with enthusiasm and enjoy every step of it. You are neither worrying not striving too hard for it. A simple, effortless, awakened and gamelike chasing of your goals will ensure that they will become your outer reality as well.

Fact finder will also assess your risk tolerance, work out your networth, insurance requirement and estate planning.

We have our research based investment avenues that will make sure that your portfolio gets the best avenues based on your goals, time horizon and risk tolerance.

After feeding all the qualitative and quantitative information, our system would be capable of developing the comprehensive financial plan for you. The comprehensive financial plan will be developed by the financial planner and approved by the Chief Financial Planner before presenting to the client. We will also have Robo plans that the client can develop on his own and if feel can discuss it with our planners.

We will also have a short version of financial plan, that would require much simpler information and plan is developed and can be implemented immediately

Invest in the NOW

The last letter of AWAKEN stand for NOW. Your entire life is NOW. Any change will happen in the now. Whatever we have done so far needs to be implemented NOW. Your dreams are asking you to take action NOW. Ofcourse you should review your plan independently without the influence of your planner, but take the time bound decision to implement the plan NOW.

Once you approve your financial plan and decided to implement your plan, our platform will help you in the most efficient manner possible.

We provide all the execution facilities such as -

We will develop your portfolio into goal based portfolio and according to set asset allocation. You can always watch your portfolio. We recommend you to watch your portfolio on a regular basis and keep monitoring its progress. Rest assured that we are also watching it on a regular basis and give you timely reminders and suggestions.

We will do a quick review of your portfolio on quarterly basis and there will be a full review on annual basis. Our review meeting are not just the review of financial plan rather these are the motivational sessions that will give you renewed energy and enthusiasm to take a fresh guard for your dreams.

Once you approve your financial plan and decided to implement your plan, our platform will help you in the most efficient manner possible.

We provide all the execution facilities such as -

- Term Insurance

- Mediclaim

- General Insurance

- Mutual Funds

- Stocks

- Some Bonds and FDs

- Real Estate

- Alternate Investments

- Tax Planning

- Estate Planning

We will develop your portfolio into goal based portfolio and according to set asset allocation. You can always watch your portfolio. We recommend you to watch your portfolio on a regular basis and keep monitoring its progress. Rest assured that we are also watching it on a regular basis and give you timely reminders and suggestions.

We will do a quick review of your portfolio on quarterly basis and there will be a full review on annual basis. Our review meeting are not just the review of financial plan rather these are the motivational sessions that will give you renewed energy and enthusiasm to take a fresh guard for your dreams.